Event Recap: Wealth Management Demystified

/On July 7th, the YWiB Toronto team hosted our first-ever live webinar. We typically prefer to host in-person events where we can mingle, meet, and see everyone’s lovely faces, however, the COVID-19 outbreak changed our (and many organizations!) plans. We were grateful to have an accessible online platform from which to bring this session to you!

The concept for our Wealth Management: Demystified webinar came from the need for women to talk openly about and get strategic with their finances. During our research and inquiries to our community, it was clear that as women, social, cultural, structural and mindset barriers can get in the way of achieving this. It was also evident that we’re all at different stages of income, financial literacy, and goals. We wanted to be true to our commitment to serve the expressed needs of our community, so we wanted to craft a workshop with something for everyone.

Overview

We were pleased to have 20 attendees join and loved that the chat section was alive with attendee comments, questions and feedback. This made the session more engaging and interactive…it almost felt like we were meeting in person!

Our webinar opened with a warm introduction from Olivia Cummings, YWiB Toronto’s VP of Business Operations. In her own life, Olivia is very passionate about personal finance and advocating for women to take control of their wealth management planning. YWiB Toronto’s President Sandra Riano followed with a brief history of Young Women in Business and our values as well as introducing the workshop’s speakers.

Find out how to join our team: We’re currently hiring for a few exciting volunteer positions!

Speakers

This webinar was co-hosted by two brilliant, women-identified leaders in the wealth management sector. We hand-selected these speakers based on their multilayered experience, values, and inclusive approach to helping women enter and succeed in the world of finance.

Our speakers worked together with the YWiB Team to develop a presentation and workbook that promoted future-thinking and goal-planning for women, regardless of their level of financial literacy and income.

Francesca Rea, CFP® set the stage by unpacking some common mindset barriers our attendees may have been experiencing prior to and as they started their wealth management journey. She also introduced a follow-along visual model that carried on throughout the presentation and workbook. A handy tool that attendees can refer back to beyond the webinar!

Read more about Francesca Rea, CFP® in our blog interview

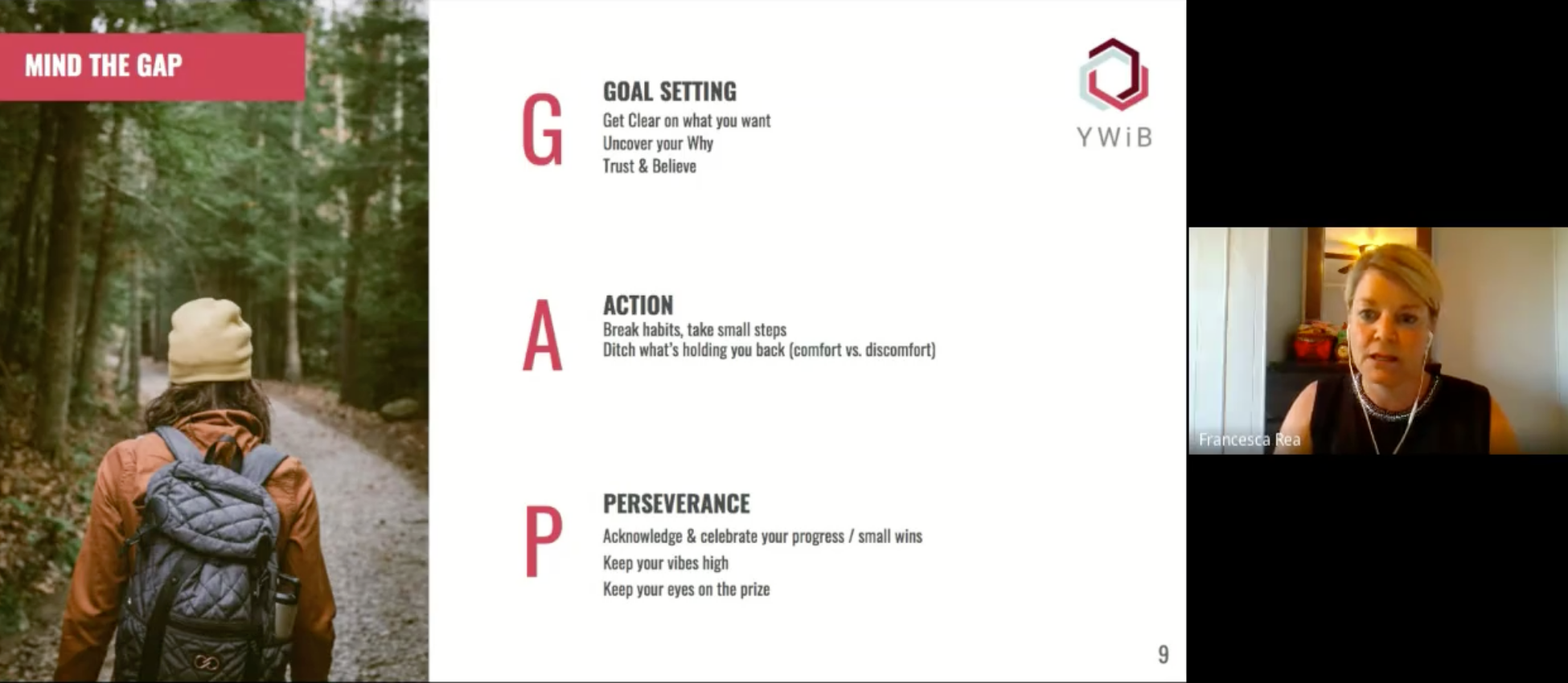

Francesca introduced an easy-to-remember GAP acronym (Goal-Setting, Action, and Perseverance) which can apply to many areas of our lives. She also encouraged attendees to seek professional advice and support when planning their financial futures. As she suggested; “We typically wouldn’t cut our own hair…we’d go to a professional we trust. It should be the same thing when it comes to wealth management, especially if you don’t have the experience or time to invest in doing it yourself.”

“We typically wouldn’t cut our own hair…we’d go to a professional we trust. It should be the same thing when it comes to wealth management, especially if you don’t have the experience or time to invest in doing it yourself.”

Read more: Choosing a Financial Planner- from the Ontario Securities Commission

Francesca’s explanation of the 6 Pillars of Financial Advice led attendees into the ‘technical’ information- the bulk of our webinar. She also walked attendees through the definitions of cash & debit, tax planning, risk management, estate & wealth transfer and a high-level introduction to investments.

Our second speaker, Neru Padmanabhan, took over from this point. Neru started by sharing a little about her background in social services and how it has ignited her passion for helping individuals of any income secure a better financial future.

Read more about Neru Padmanabhan’s approach on our blog

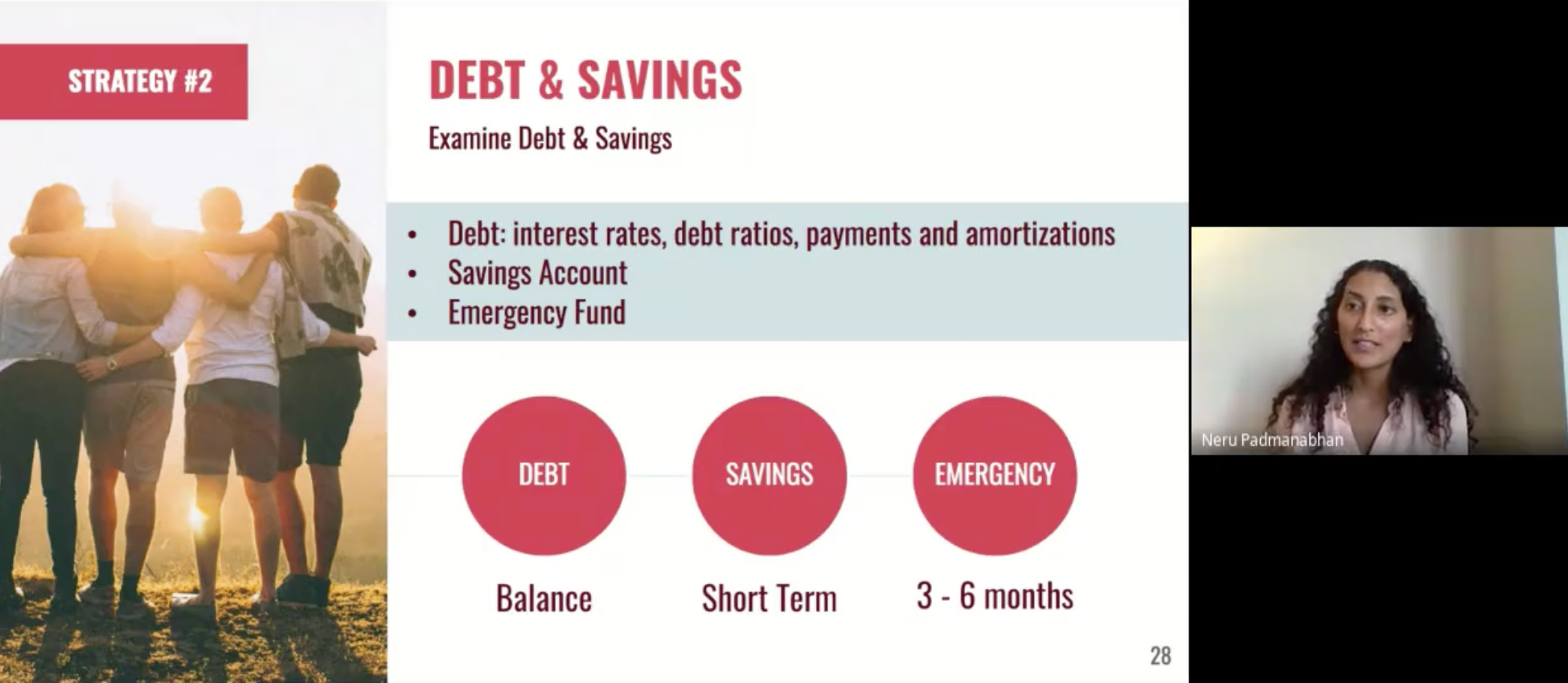

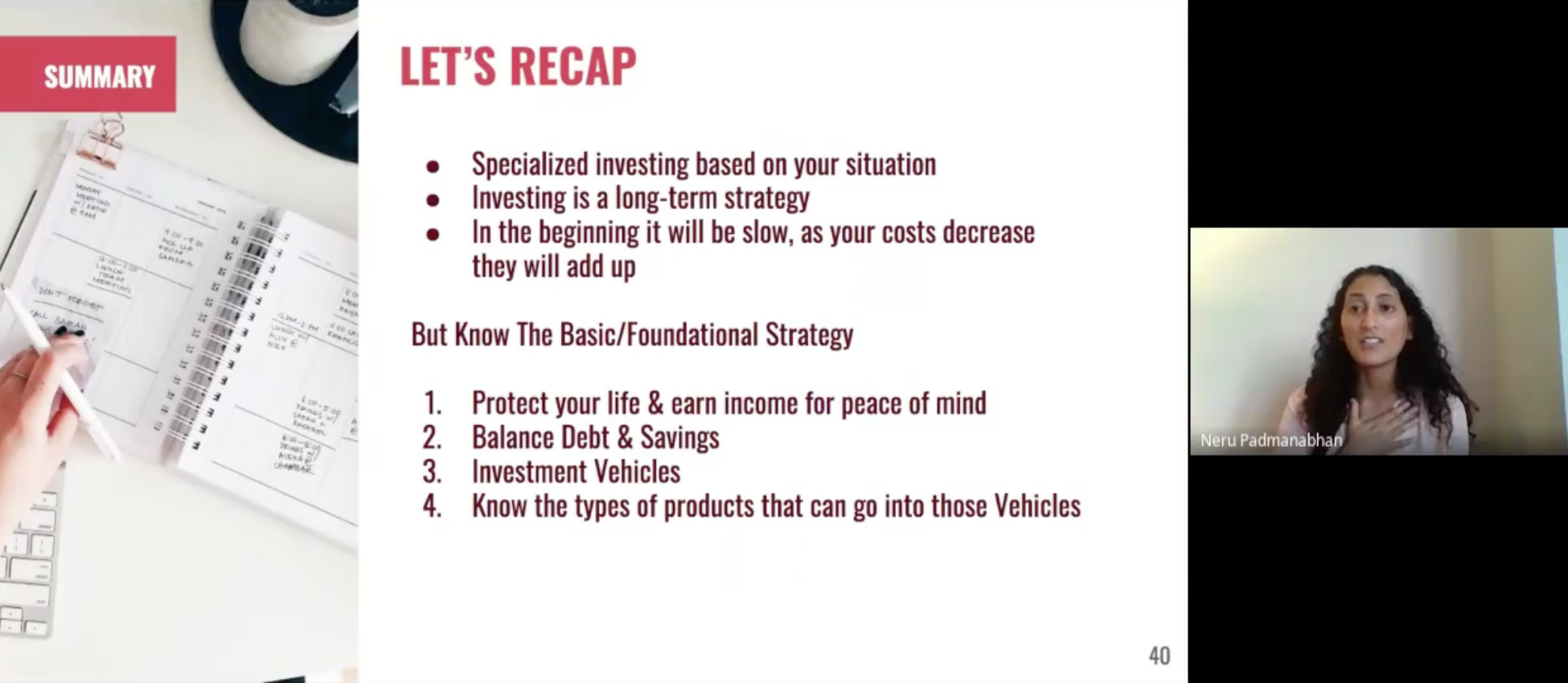

Neru introduced the Foundations of Wealth Management, including strategies for: life protection, income protection, debt & savings, and diversified strategies through investment vehicles. Neru stressed the importance of life and income protection at any age- including for young women.

Read more: Why You Need Life Insurance in Your 20s

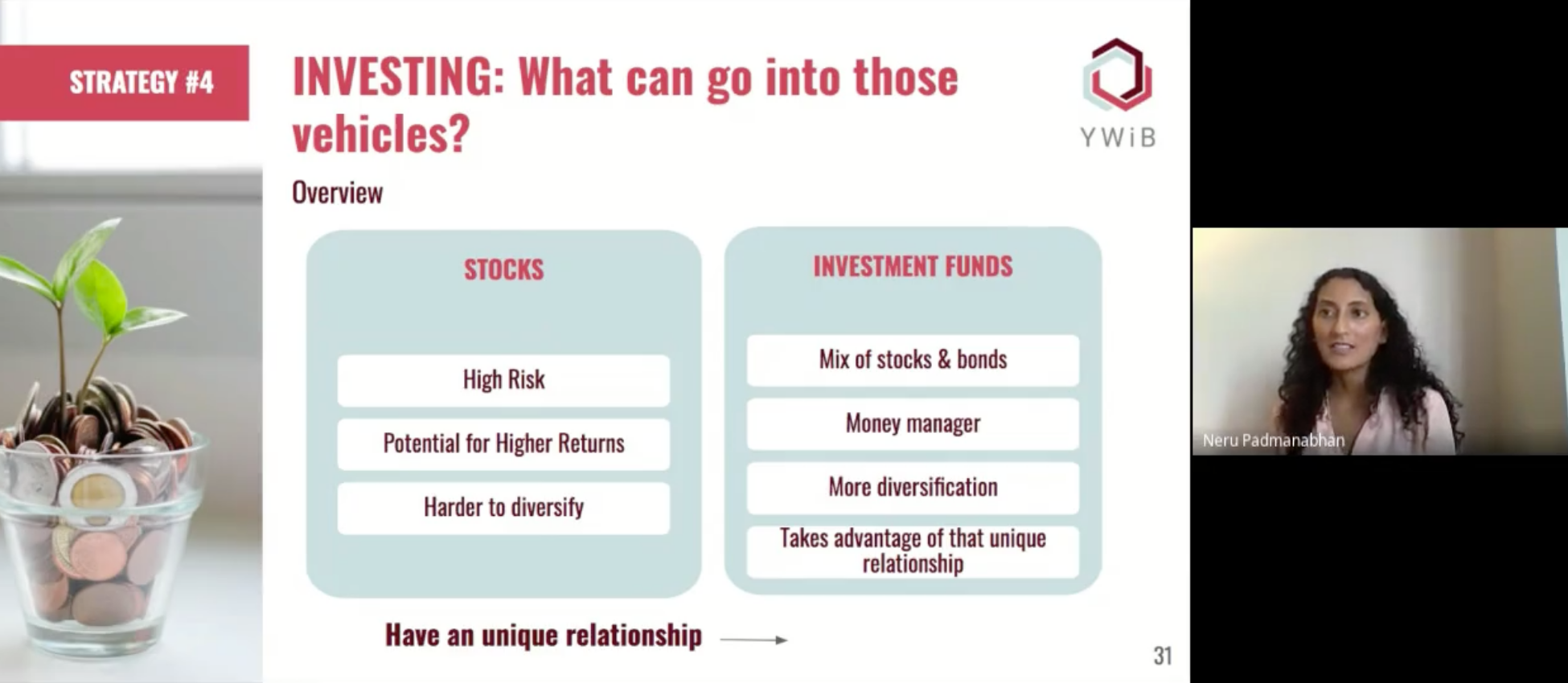

She then led attendees through Investment Funds 101 and ended the evening with a recap and self-reflection activity. Both speakers provided insightful answers during the question period, and sent attendees on their way to digest the 23-page free workbook YWiB compiled with more activities, advice, and tailored resources.

Key Takeaways

The visual model/house diagram to cement learning (see above) and provide a framework for wealth planning

Never leave finances to your a spouse or partner… life is uncertain and you need to be aware and involved so you can take the lead or plan for the future together.

Women face several unique estate planning concerns. Women have a longer life expectancy than men, making planning for their financial future more critical.

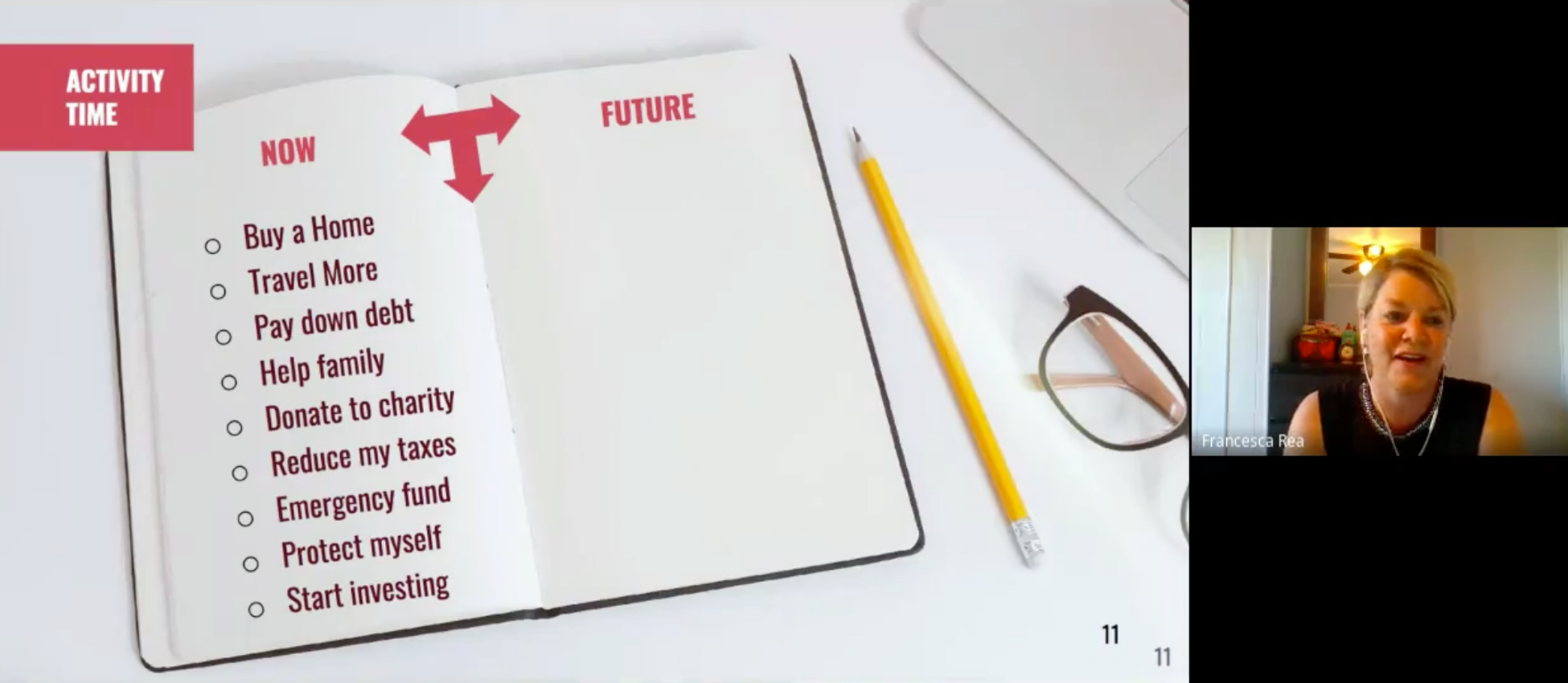

Cash management is the starting point of any written financial plan. It is important to know what is coming into your cash flow and what is going out. Take a look at your last 3 months of expenses and categorize your spending.

Only 24% of women surveyed by Fidelity Investments (2018) said they were comfortable with how much they knew about investing.

Similarly, planning for you retirement needs to start now so you have more wealth saved for the future. According to CNBC/Survey Monkey Women at Work Study (2014), 1 in 5 women have nothing saved for retirement. Start saving now, make it automatic and frequent and remember this is a long term strategy.

Careful tax planning plays a key role in keeping more money in your pocket. It is important for the financial advisor to work with your accountant to ensure you are implementing the most effective tax strategies.

Life protection (also known as life insurance) is so important at any age. If we’ve learned anything during the COVID-19 outbreak, it’s that life is uncertain and we need to be prepared as much as we can for unexpected emergencies and obstacles. The right amount of coverage is based on 10-20x your income.

Disability coverage is usually 50-70% your current income if you are unable to do your job. Disability is necessary for all individuals because Employment Insurance only covers 55% of your pay for a short period of time and no additional benefits are covered.

Critical illness insurance is usually 6 months to 1 year of income -1x lump sum payment.

Business Overhead Expense Insurance (BOW) is necessary especially for those with high operating costs and storefronts.

GICs, although ‘safe’ and preferred by most women, are not the best investment vehicle. They grow below inflation and get locked-in.

For those wanting to invest responsibly with purpose and intention to protect their values and goals, there are many investment options are: ESG (Environmental Social Governance), Socially Responsible Funds (SRI) Impact Funds or Faith-based Funds.

How to start building your future: (a) Pay yourself first, (b) Always ask yourself does that strategy work for me? (c) Revisit & evaluate every year, (d) You are never too young to start saving, (e) Once you commit, all you need is habit and consistency.

There are many options/packages to choose from but don’t let that confuse you, seek help from a financial professional you trust and ensure everything you choose meets your needs and aspirations.

Finally, remember:

Doing the best at this moment puts you in the best place for the next moment.

- Oprah Winfrey

Draw Winners

Attendees were asked to fill out a feedback survey in exchange for a ballot in our giveaway draw. We are pleased to announce that Sixtine Le Chatelier & Monisha Singh will both receive a copy of The Wealthy Barber book by Canadian author David Chilton!

Giving Back

All ticket proceeds (after Eventbrite fees) from this webinar will be donated to the CEE Centre for Young Black Professionals. Through our suggested ticket price and PWYC option, we raised $335 to support this important local cause that is dear to our hearts.. Thank you to all who attended and donated!

What’s Next for YWiB Toronto

We’re working on something big! Stay tuned for exciting announcements from our team- via Instagram, our Mailing List, and on LinkedIn!

Visual Recap